Navigating taxes can be tricky for online business owners. Effective strategies help save money and avoid pitfalls.

This blog post explores key tax strategies tailored for online entrepreneurs. Starting an online business is exciting but comes with tax responsibilities. Understanding these can impact your bottom line. Proper tax planning boosts profits and ensures compliance with tax laws.

Online business owners face unique challenges, like handling sales tax in multiple states and deducting home office expenses. Knowing the right strategies can make a big difference. In this guide, we will explore essential tips to help you manage your taxes effectively. By the end, you will have practical insights to keep your business financially healthy and legally compliant. Ready to take control of your taxes? Let’s get started!

Credit: www.youtube.com

Introduction To Tax Strategies

Tax planning is very important for online business owners. It helps save money. Good planning also prevents errors. Owners can avoid penalties. Proper planning helps in understanding tax laws. It leads to better financial decisions. Good tax planning also ensures compliance. This builds trust with authorities. It can also improve cash flow. Planning ahead is key to success.

Online business owners face many tax challenges. Tracking income is one challenge. Keeping track of expenses is another. Understanding different tax rates is hard. Handling sales tax can be confusing. Filing taxes on time is crucial. Staying updated with tax laws is important. Navigating deductions is tricky. Managing international taxes is complex. All these challenges need attention.

Credit: m.facebook.com

Choosing The Right Business Structure

A sole proprietorship is the simplest business structure. You and your business are one entity. This means you are responsible for all business debts. It also means profits are taxed as personal income. No need for separate tax returns. Easy to set up and manage. But, you bear all the risks.

LLC stands for Limited Liability Company. It offers protection against personal liability. Profits are taxed only once. An LLC is flexible and has fewer formalities. On the other hand, a corporation is a more complex structure. It provides strong liability protection. But, profits can be taxed twice. Corporations must follow strict rules and regulations.

Deductions And Credits

Online business owners can reduce taxable income through deductions and credits. These strategies lower the overall tax bill, maximizing savings.

Home Office Deduction

Online business owners can claim a home office deduction. This deduction applies if you use part of your home for business. The space must be used regularly and exclusively for your work. This can reduce your taxable income. To calculate, measure your office space. Compare it to your home’s total area. This gives you a percentage to use for the deduction. Keep records of expenses like rent, utilities, and repairs. These can all be part of your deduction. Make sure to keep receipts and documentation.

Business Expenses

Claiming business expenses helps lower your tax bill. Common expenses include office supplies, software, and advertising costs. Travel for business can also be deducted. Meals with clients are deductible too. Keep detailed records of all expenses. Use a spreadsheet or accounting software. This makes it easier to track and claim deductions. Remember, only business-related expenses qualify. Personal expenses should not be mixed in. Be honest and accurate in your reporting.

Sales Tax Compliance

Nexus means a link between your business and a state. This link requires you to collect sales tax. Each state has different rules. Some states have a physical presence rule. Others have an economic presence rule. Know the rules for each state where you sell.

First, you must collect sales tax from buyers. Then, you must remit this tax to the state. Use software to help you with this. It makes the process easier. Always keep track of your sales and taxes. This helps avoid mistakes.

Income Splitting Techniques

Hiring family members can reduce your tax bill. Pay them a fair wage. This way, you can spread income among lower tax brackets. Kids can help with simple tasks. Spouses can handle customer service. Keep good records for tax purposes.

Paying dividends to family members can be smart. Dividends are taxed at a lower rate. This can save money. Make sure family members own shares. This method works well with older children or spouses. Always follow the tax rules.

Retirement Planning

A Solo 401(k) is great for online business owners. This plan helps you save for retirement. You can contribute as both employer and employee. This means higher savings. Contributions are tax-deductible. Your money grows tax-free until retirement. It is easy to set up and manage.

A SEP IRA is another good option. It is simple and low-cost. You can contribute a percentage of your income. Contributions are also tax-deductible. It is great for small businesses with few employees. Your money grows tax-deferred. This plan offers high contribution limits. It is flexible and adjusts with your income.

International Tax Considerations

Working with customers from other countries can be tricky. Different countries have different tax laws. Knowing these laws helps avoid trouble. Use clear records for all foreign transactions. Keep track of all payments and receipts.

Some countries charge VAT or GST. Make sure to collect and pay these taxes correctly. Using an expert can help keep things simple. Experts can also help avoid mistakes.

Double taxation means paying tax twice on the same income. This can happen with international sales. Many countries have tax treaties to prevent this. These treaties help reduce extra taxes.

Check if your country has treaties with your customers’ countries. This can save money. Follow the rules to benefit from these treaties. Good records are key. Always keep detailed and clear records of all transactions.

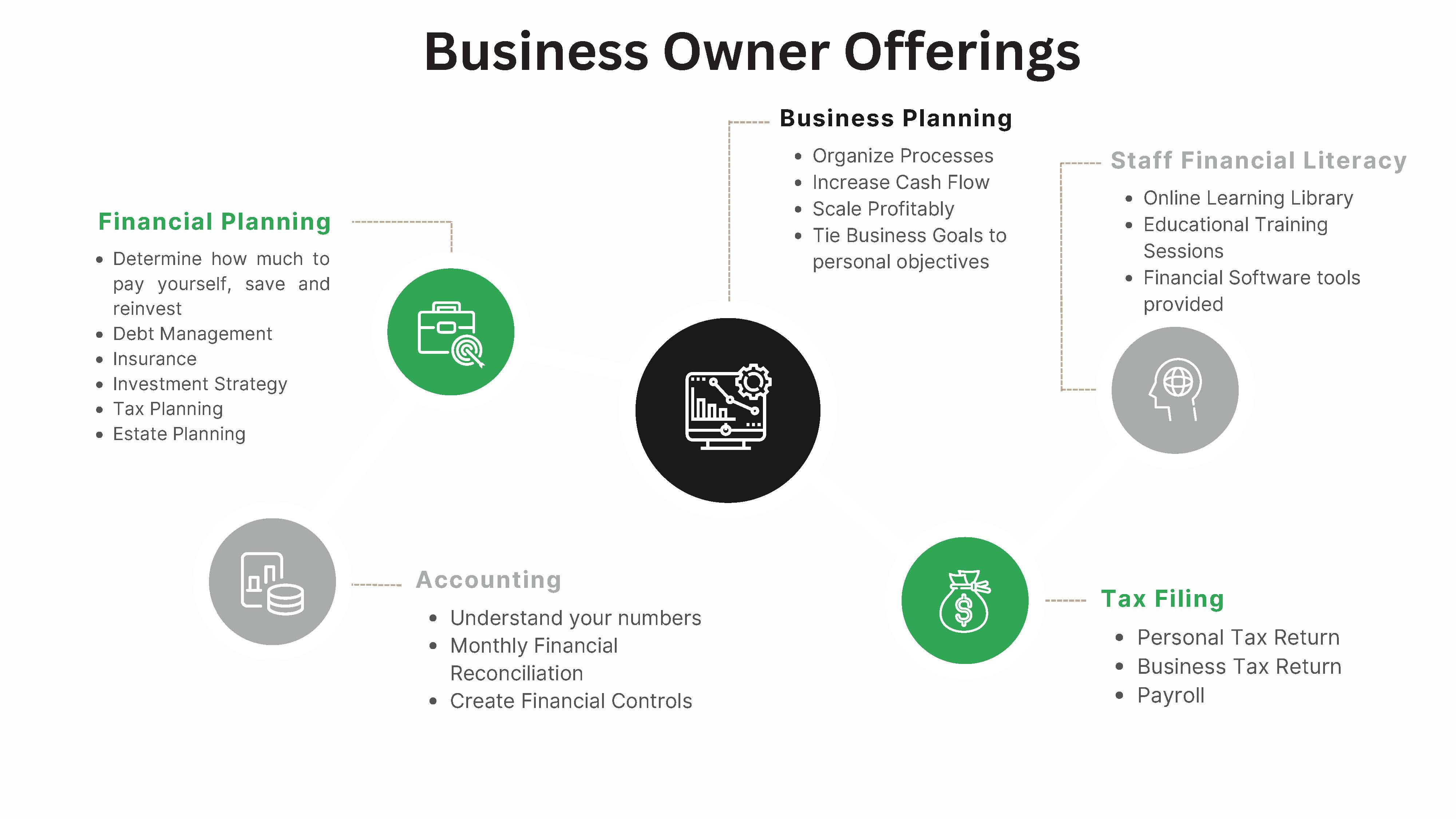

Credit: www.logosfinancialgroup.com

Utilizing Tax Software And Advisors

Tax software can make filing easy. It helps avoid mistakes. Many programs offer step-by-step guides. They can find deductions and credits. This saves money. Updates are automatic. New tax laws are included. Time is saved. Most people file faster.

Pick someone with experience. Look for a good track record. Ask for references. Check reviews. A good professional knows the latest tax laws. They can give advice. They help plan for the future. Fees vary. Compare costs. Pick what fits your budget.

Year-round Tax Planning

Pay taxes four times a year. This is crucial for online business owners. Missing payments can lead to penalties. Calculate your income every three months. Use this to estimate taxes. Pay on time. Stay organized. It helps avoid stress at year-end.

Keep all receipts and invoices. Store them in a safe place. Use digital tools if possible. Track expenses daily. Separate business and personal expenses. This makes tax filing easier. Good records can save money. They help prove deductions. Make this a habit.

Conclusion And Next Steps

Proper tax strategies can save online business owners money and avoid legal issues. Implement these tips to optimize your tax planning.

Review And Adjust Annually

Review your tax strategies every year. Things change. New rules come up. Your business grows. Adjustments help you save money. They also keep you compliant with tax laws.

Stay Informed On Tax Laws

Tax laws change often. Stay updated to avoid mistakes. This helps you plan better. You can seek help from a tax advisor. They know the latest laws. This saves you time and stress.

Frequently Asked Questions

What Are The Best Tax Strategies For Online Businesses?

Effective tax strategies include claiming all eligible deductions, using tax software, and hiring a professional. Keeping accurate records is also crucial.

How Can Online Businesses Reduce Their Tax Liability?

Online businesses can reduce tax liability by tracking expenses, using home office deductions, and maximizing retirement contributions.

Are There Specific Tax Deductions For Online Business Owners?

Yes, online business owners can claim deductions for internet costs, software, home office expenses, and advertising.

How Do Online Businesses Handle Sales Tax?

Online businesses must collect sales tax based on the buyer’s location. Using tax software can simplify this process.

Conclusion

Effective tax strategies can save online business owners time and money. Understanding deductions and credits reduces your tax burden. Keeping accurate records helps you stay compliant. Consult a tax professional for personalized advice. Staying informed on tax laws is crucial.

Implement these strategies to optimize your finances. Running an online business is challenging, but smart tax planning makes it easier. Start today and see the benefits.